r&d tax credit calculation example

With Corporation Tax at 19 youll be expected to pay 123500. The 32500 is therefore the qualifying amount added to other eligible costs.

R D Tax Credit Calculation Examples Mpa

The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading income.

. When subtracting it from the original corporation tax before the claim the total saving for this RD tax credit calculation example would be 24700. The RRC is an incremental credit that equals 20 of a taxpayers current-year QREs that exceed a base amount which is determined by applying the taxpayers historical percentage of gross receipts spent on QREs the fixed-base percentage to the four most recent years average gross receipts. Of supplies used in RD.

Learn If Your Company Qualifies For Research Experimentation RD Tax Credit Today. Youll calculate your quantifying expenditure. Profitable SME - RD tax savings equate to approx 25 of the eligible spend.

Fifty percent of that average would be 24167. For profit-making businesses RD tax credits reduce your Corporation Tax bill. Just follow the simple steps below.

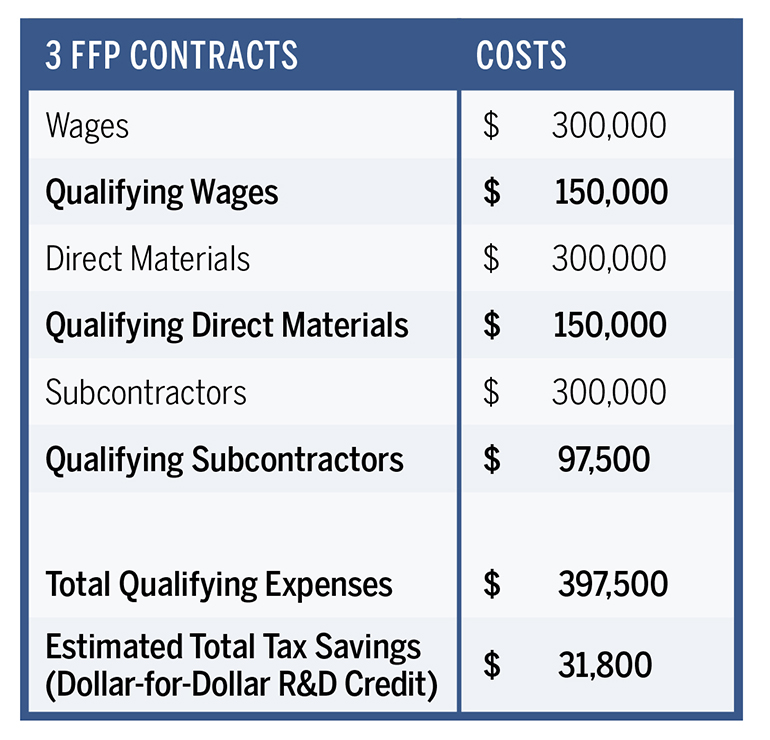

Your business spent 120000 on R. Use our RD tax credit calculator above to estimate how could save. If there is a 100000 payment to a subcontractor of which half is for RD activities the calculation would be 100000 x 50 50000 x 65 32500.

Assuming your business fits these criteria you can check below for example calculations for RD tax credits. In other words small business and start-up companies may be eligible to claim up to 25000 per year for up to five years in a total amount of 125 million 250000 x 5. 100s of Top Rated Local Professionals Waiting to Help You Today.

A Profitable SME RD Tax Credit Calculation Lets assume the following. Just like before youll then multiply your qualifying expenditure by 130. Select whether the company is profitable or loss making.

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. 70000 - 24167 45833 x 14 6417. Total Amount spent on 3rd Parties involved with RD.

You can save about 10 percent of your eligible RD costs up to two hundred and fifty thousand dollars per year for up to five years. Select either an SME or Large company. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend.

If youre a loss-making business youll receive your RD tax credit in cash because you dont have a tax liability to offset. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows. So if you have about 25 million dollars in engineering RD expenses for last year you can get that full credit.

The controller then added the amounts calculated for each employee to calculate the initial estimate of total wages incurred for qualified services. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion for corporations and 12 billion for individuals. Your business has made profits of 650000 for the year.

The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. The rate of relief is 25. A to Z Constructions average QREs for the past three years would be 48333.

If the company spent 100000 on RD projects in a year then its potential RD Credit would be 9700. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Guidance on this can be found on our Which RD scheme is right for my company page.

It was increased to. Of Employees involved with RD. So on say 100000 of eligible costs a profitable company could save approx 25000 and a loss-making company could recover approx 33000 as a payable credit.

The denominator was the number of projects that the taxpayer believed to involve 50 hours of work by employees. RD Tax Credit Estimating Tool. Loss-Making SME Calculation Example 1.

For taxpayers that had QREs in calendar years 1984 through 1988 that is the. However RD tax credits are calculated differently to profit-making companies. So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill.

If your business made a loss it can still benefit from the government incentive. Ad RD Tax Credit Claims Developed For Clients Short-Term Long-Term Success. Loss making SME - RD tax savings equate to approx 33 of the eligible spend.

Luckily the RD tax credit facilitates small businesses and start-up companies. 12 from 1 January 2018 to 31 March 2020. The taxpayer multiplied this estimate by a fraction based on a statistical sample.

4 The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA. When you qualify as an SME in terms of the SME scheme but youre making a loss instead of a profit the RD Tax Credit Calculation is the same as the procedure set out above.

Naked Credits And The Interest Expense Limitation

R D Tax Credit Calculation Methods Adp

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Why Research Funding Sources Complicate Tax Credits Research Development World

The R D Tax Credit Aspects Of Saas Start Ups R D Tax Savers

R D Tax Credit Calculation Methods Adp

Rdec Scheme R D Expenditure Credit Explained

Financial Ratios Statement Of Cash Flows Accountingcoach Financial Ratio Cash Flow Statement Financial

American Opportunity Tax Credit Aotc Definition

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

A Simple Guide To The R D Tax Credit Bench Accounting

Cash Invoice Templates 14 Free Printable Xlsx And Docs Formats Invoice Template Invoice Layout Templates

R D Tax Credit Calculation Examples Mpa

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Taxtips Ca Ontario Non Refundable Lift Credit

Download Sales Commission Calculator Excel Template Exceldatapro Excel Templates Excel Spreadsheet Template